Classic car insurance – specialized insurance coverage for less

If you own a “classic” car, which could be considered anything over about 25 years old, you could save money on your car insurance by buying specialized classic car insurance.

If you own a “classic” car, which could be considered anything over about 25 years old, you could save money on your car insurance by buying specialized classic car insurance.

There are two ways to find insurance for your older vehicles. The first is to check with your current insurance company to see if they have a rating classification for classic or antique autos. This rate will be significantly less than a pleasure use rate, but it may also come with some mileage or usage limitations.

The other way to insure your classic car is to use an insurance company that specializes in insuring restored vehicles. Their policies have unique coverages that may not be available with an ordinary car insurance policy. Here’s a breakdown of some of the categories of classic vehicles you might want special coverage for:

- Antique & Classic Cars – Consist of stock vehicles built from the turn of the century through approximately 1969. Examples include a 1957 Ford Thunderbird, 1901 Oldsmobile and a 1930 Model A.

- Exotic and Special Interest – These are rare or limited production vehicles such as specific models of Lamborghini, Ferrari and Dodge Vipers.

- Fire Trucks – Retired collectible vehicles such as fire trucks, semi-tractors and busses can be insured as classic vehicles.

- Lowriders – Cars modified with hydraulic or air bag suspension systems can often be insured as classic cars, but underwriting guidelines are strict.

- Military Vehicles – Vehicles such as a 1951 Willys Jeep or a 1941 QMC Amphibian can be insured as a classic vehicle.

- Modern Classics – These are vehicles of modern production that are considered collectible such as a 1976 Chevrolet Corvette, a 1978 AMC Pacer or a 1979 Trans Am T-Top.

- Motorcycles and Scooters – Motorcycles are becoming increasingly expensive and thus collectible. Examples of motorcycles insurable as collectibles are a 1948 Indian Chief and a 1952 Harley Panhead.

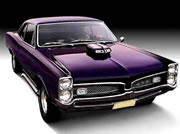

- Muscle Cars – Typically late 1960’s and early 1970’s U.S. models that include larger V-8 engines. Examples include a 1969 Chevrolet Camaro, 1970 Dodge Charger and a 1970 Plymouth Barracuda.

- High Quality Replicas – The are home-built or professionally constructed replicas of older vehicles.

- Street Rods – Street rods include vehicles that have been extensively customized for performance. Examples include a 1932 Ford Highboy or a chopped 1951 Mercury Coupe with custom paint.

- Tractors – Collecting antique tractors is an enthusiastic hobby and they can be insured as classic vehicles.

- Trucks or Pick-ups – Older models of trucks can be insured as a classic vehicle just as a car can be. Examples include a 1922 Model T Truck, a 1951 Chevy Pickup or even a 1975 Ford Pickup.

- Vehicles Under Active Restoration – Even if you haven’t gotten the primer and paint complete, you can insure your classic while being restored.

Advantages of Classic Car Insurance

The typical classic car insurance policy offers better coverage at a reduced premium than a typical auto insurance policy. This is due to the fact that most classics are not driven as much or under the same circumstances as your regular vehicles. The policies may allow only a certain number of annual miles driven, but the return is a greatly reduced premium for insuring your classic car.

Typical benefits of the classic car insurance policy include:

- Lower premiums

- Agreed value coverage – this means your car is insured for a specific value that you will be paid in the event of a total loss

- No deductible – many classic car policies do not have a deductible, so you will not have to pay anything out-of-pocket in the case of a claim

If you have a classic that’s been collecting dust because you haven’t wanted to pay for the insurance, you have low-cost insurance options to get it on the road. Get a competitive classic car insurance quote by simply entering your zip code below and completing the fast quote form!